Exploring Finance

The Finance Professional Development (FPD) programs’ Fundamentals (formerly EFE) engages first-year students in identifying internship and career fit through weekly workshops, panels, and lectures.

Most full-time job placements in finance result from junior summer internships. The Fundamentals provides foundational knowledge of different industry areas in finance and prepares students to make timely and complicated career decisions.

The Fundamentals is the first part of the FPD program. It is free for students to join, it is extracurricular, and does not require a formal application or registration fee.

Although FPD is a natural fit for finance majors, it is open to all non-finance undergraduate students who intend to pursue a business major, or a combination degree program in the Warrington College of Business.

Stephanie Fajre

EFE Program Facilitator

352.273.2138

Email Mrs. Fajre

Lessons & Timeline id="lessons"

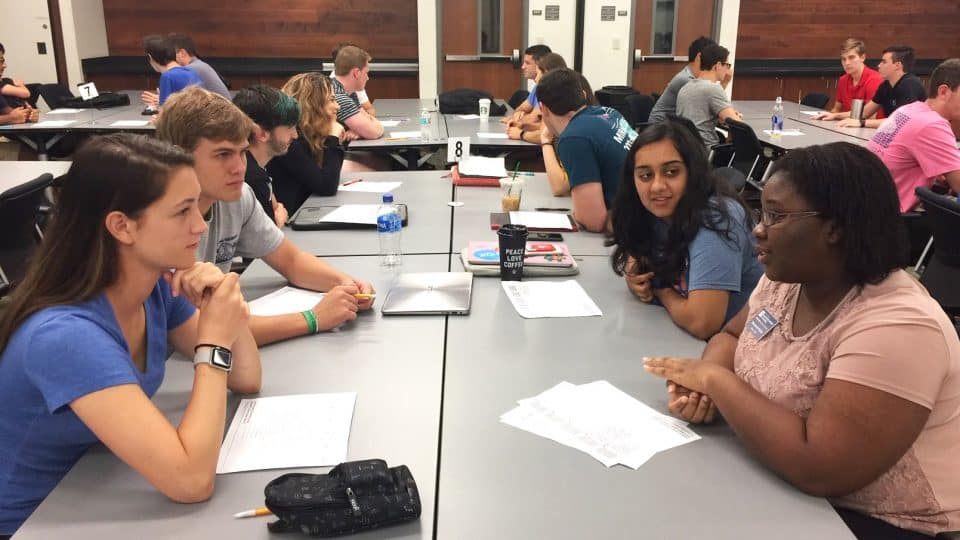

Team-Based Learning

Lessons incorporate the Team-Based Learning approach and a “Learn, Think, Decide” structure. Lessons are sequential and include pre-reading, assessments, direct instruction, and post-assignments. Students join a cohort of like-minded peers and work in teams to engage in discussions and complete activities that correspond with that week’s lesson.

Fundamentals Lessons

Through the lessons, students will:

- Learn about the different areas of industry in finance

- Decide if FPD participation is valuable

- Construct an industry-appropriate resume

- Determine the best educational path for top candidacy and internship performance

- Maximize networking and enhance written and verbal communication

- Build a foundation for behavioral interview preparation

- Map personal values to jobs in finance

- Create and maintain a routine for following markets

- Enhance decision making and career discernment abilities

- Engage in academic lessons and workshops

In addition to the facilitator-led lessons, participants will have access to:

- Video interviews with seniors discussing their summer internships in:

- Asset Management

- Consulting

- Commercial and Corporate Client Banking

- Corporate Finance

- Equity Research

- Investment Banking

- Sales and Trading

- Wealth Management

- And more!

- Office hour sessions to discuss decision making and resume building with Mrs. Fajre

- Introductions to older students and FPD Tracks

- Templates for resume, emails, elevator pitch, and interview preparation

- Academic lectures led by faculty in the Finance, Insurance and Real Estate Department

Recommended Timeline

| When | Activity |

|---|---|

| First Year | Participate in one-semester FPD Fundamentals (formerly EFE) |

| Second and Third Year | Join FPD Industry Track(s) for area-specific preparation and professional development |

| Third Year Summer | Complete internship |

| Final Year | Return to campus having accepted a full-time offer and volunteer to lead FPD events, panels, and activities |

Class of 2025 Testimonials id="testimonials"

Coming into college as a freshman finance student, I had no idea which direction I wanted to take or what careers even existed for that matter. This program was able to provide me with exactly what I needed as a student, and my goals have become significantly clearer over the course of this semester.

I started with absolutely no idea what I could do in finance or what I was interested in; I actually remember writing about these concerns in one of our earliest assignments. But now, I can confidently say I know what most finance jobs entail… I genuinely can’t express how grateful I am to have had this experience.

I have learned so much, and I can see myself using the skills and information taught over the past months throughout college and into my career. The last few sessions were particularly helpful as I appreciate speaking to industry experts and older students who can offer a perspective that is hard to find elsewhere.

Register to Join id="register"

Requirements and Expectations:

- The Fundamentals is started during the first week of either the fall or spring semester. Due to the early hiring timelines, students are highly encouraged to complete it during their first year.

- Students should dedicate about 3-5 hours per week to scheduled lessons and instructional materials.

- Successful completion requires consistent attendance, submission of assignments, and tangible signs of development.

- Upon completion of the Fundamentals, students continue their development in an FPD Industry Track of their choosing.

- Current second-year, third-year, or transfer students should contact Mrs. Fajre to confirm their timeline before submitting the registration form.