Research

Faculty Interests

The faculty’s depth of research achievement and quality of teaching constitute the strength of the program. The senior faculty are widely recognized as leaders in their contributions to the educational and research growth of the profession. For example, in a 2008 study of “top journal publications,” we came in 13th overall and third among public universities, and U.S. News ranked our research number 6-7 among public universities in 2009, 2011, and 2012. In addition, UF Department of Finance, Insurance and Real Estate faculty serve as officers of national professional organizations and as editors and reviewers at major finance and real estate journals. We are particularly proud of our junior faculty, who are actively researching new theories and expanding the knowledge of our profession.

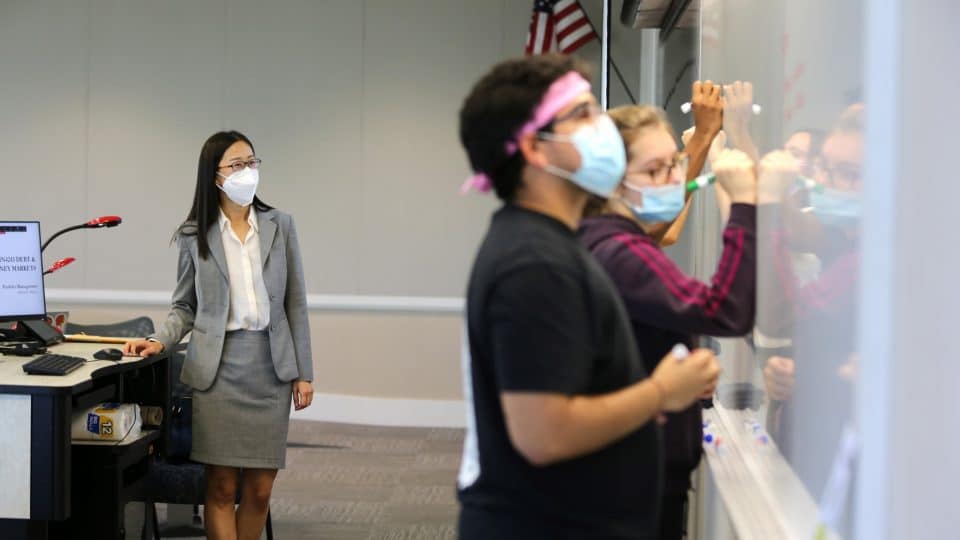

Student-Faculty Interaction

The University of Florida is unusual in the extent to which faculty and doctoral students work closely with one another to develop each student’s research career. For example, our doctoral student Minmo Gahng worked closely with Professor Jay Ritter and their research has been widely cited by practitioners and financial media, including the Wall Street Journal and Bloomberg. This close working relationship between faculty and students continues well beyond the graduation. One of the three authors of the research, a professor of finance at the University of South Carolina, Donghang Zhang, graduated from our PhD program in 2002.

Another example of our doctoral student and professor interaction can be seen with Jing Lu and Professor Chris James. “We provide evidence that small banks responded faster to Paycheck Protection Program (PPP) loan requests and lent more intensively to small businesses than larger banks. Using community bank pre-pandemic share of deposits/assets as an instrument for the intensity of PPP lending, we find a negative and significant relationship between county level bankruptcy filings and PPP lending per small business. Overall, our findings suggest that community banks remain an important conduit for small business credit particularly during crises when a rapid response is required.” Read more in the article, “Community banks a key resource for small businesses when crises arise.”