Mobile Location Data is Reshaping Commercial Real Estate

It was not that long ago that commercial real estate professionals would draw circles on road maps to help pinpoint the best place to locate a business. These concentric rings might show the one- to five-mile radius from a given piece of property — and served as a starting place to help clients select a site for a retail store or to decide whether to invest in a local shopping center. That began to change with the advent of more powerful mapping and geographic information systems, big data computing and Apple’s introduction of the iPhone in 2007.

Smartphones have since become ubiquitous, of course — and so has mobile location data, the digital tracks left by the continuous pinging of the GPS on mobile devices of hundreds of millions of people every day. Consumers may not think much about it, but they share their location whenever they use countless apps on their smartphones, such as checking weather forecasts, driving directions or airline flight times. And, if real estate is all about location, then this ocean of mobile location data is a gold mine to help with site selection, development, investment and retail merchandising.

“Foundationally, probably the highest and best use of mobile location data is to look at customer trade areas,” or the geographic distance retail consumers travel, said Gregg Katz (MBA ’08). He heads product marketing and innovation for Creditntell, a Great Neck, New York-based consulting firm that provides a platform to analyze location data and the financial health of retail companies.

Creditntell — and rival firms such as Placer.ai and Near Intelligence — captures customers’ movements through a process called geofencing. Essentially, this allows users to draw digital boundaries around a city, neighborhood or even a specific store and gather information about all the people — more precisely, every mobile device — passing through it. “When the device enters into that geofence area that’s counted as a visit,” Katz said. “We can track retail trade area based on actual visitation, on who is actually coming to that location and how often they visit.”

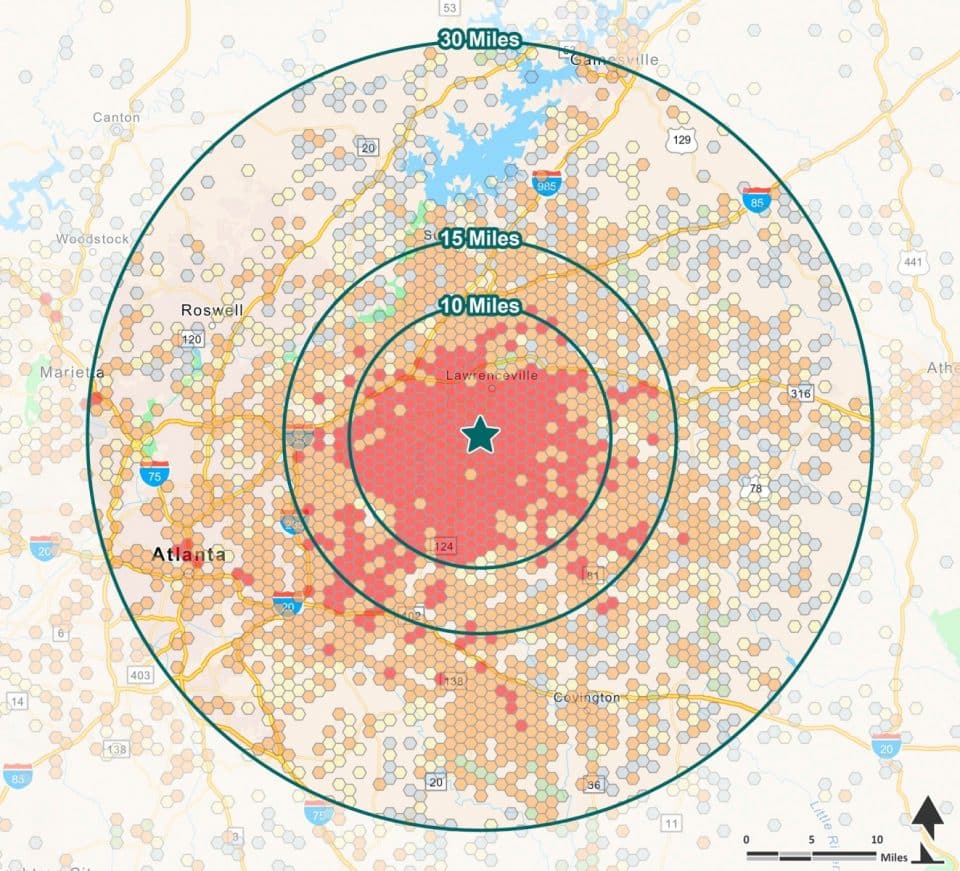

As a result, instead of uniform circles, actual trade areas are shaped more like “amoebas” that may stretch in unexpected directions based on real visitor traffic — not a broker’s best guesses. The data can paint a detailed picture of how people move throughout a day, week or year — where they live and work, where they are now, where they’ve been and how long they visited — and identify business opportunities. (Figures 1 and 2)

Traditional and GPS Shopping Center Trade Area

This map shows device home location density for visitors to an example shopping center in 2021. During the study period there were an estimated 3.6 million visits from an estimated 728,000 unique visitors.

In-Center Visit Share

- Sprouts Farmers Market 11.6%

- Long Horn Steakhouse 7.9%

- H&M 6.9%

- Chili’s Grill & Bar 6.8%

- Wild Wing Café 6.5%

- Barnes & Noble 5 9%

- DSW 4.6%

GPS Home Location Trade Area

Device Density | % of Customers Core

- Primary Trade Area 62.58% — core trade area

- Secondary Trade Area 30.18%

- Tertiary Trade Area 4.02%

- Quaternary Trade Area 0.36%

- Quinary Trade Area 2.87%

| Visitor Journey | Pre-Visit to Example Shopping Center | Post-Visit to Example Shopping Center |

|---|---|---|

Home | 55.9% | 61.8% |

Work | 3.9% | 5.1% |

Companies also use location data to assess the competition by analyzing rivals’ traffic trends. It’s not used just by retail-oriented real estate businesses, either. Operators of multifamily projects and office buildings use the data to understand occupancy levels, commute times and the flow of visitors, especially in the post COVID period, Katz said. This data can provide property owners insights to improve the mix of amenities they offer and better appeal to tenants and customer segments.

Mash up of data sources

Despite its power, real estate professionals caution that mobile location data is no silver bullet. It can’t replace “boots on the ground” — referring to real estate brokers’ institutional knowledge of the quality of different neighborhoods, commercial corridors and the local market. Instead, mobile location data is part of a mash up of technology and data sources aimed to make commercial real estate more efficient, profitable and less risky. Other sources include detailed demographics, cloud-based GIS mapping systems, psychographics and “geosocial” data of people’s social media activity.

Figure 2 – Source: TSCG

“This is the science that backs up the knowledge our brokers have,” said Bob Wordes (BA ’77), chief operating officer of Atlanta-based TSCG (formerly The Shopping Center Group), a major retail-only real estate service provider. “We wanted to bring science to that art and back it up with really good data to help our brokers execute their strategy. It makes things more efficient and takes out hunches.” TSCG represents 400 retailers and restaurant chains and manages millions of square feet of space. It employs numerous data location specialists trained in GIS, geography and meteorology to analyze mobile location data and generate market research for tenants, landlords, developers and investors. It layers in psychographic information from Esri, a Redlands, California-based company known for its GIS mapping software. Its Tapestry product breaks down the customer attitudes in neighborhoods by “LifeMode” groups made up of 67 consumer segments with commonly shared traits. TSCG also examines geosocial data from a Cincinnati-based startup, Spatial.ai, that collects and aggregates down to the census block discussions people are having on social media platforms like Facebook, Instagram and Twitter. This activity is segmented into categories of personas of local consumers with labels such as “fueling for fitness” and “smart chic” — shorthand ways of categorizing people’s behaviors and personalities.

All this work informs the research-driven stories companies can tell clients about markets, trade areas and the potential sites. You can spot patterns you wouldn’t have otherwise seen and build personas of consumers with shared affinities and shopping habits, Katz said. For example, by analyzing visitation levels, website searches and social media patterns you can identify local coffee drinkers who go to yoga studios, drive Volvos and shop at Trader Joe’s and Nordstrom’s. This is valuable information for the operator of, say, a shopping center looking to fill a space with a tenant that can draw customers who may stay on a property longer and visit more often.

“It’s a differentiator for us,” TSCG’s Wordes said. “We can build merchandising strategies around this data. That’s what we are doing every day on the leasing side for any shopping center we are working.”

Risks, privacy concerns and limitations

Real estate and retail companies make up just a slice of the market for mobile location data, which has become a multibillion-dollar business. This ecosystem includes app developers that collect location data, data brokers and aggregators that buy it, and location intelligence firms and others that analyze it for purposes ranging from advertising to government enforcement.

Katz said before Creditntell and other retail location specialty companies get the data, it is stripped of personally identifiable information and its accuracy is limited to perhaps 100 yards. This “fuzzy” data amounts to rows and rows of time-stamped geographic coordinates of potentially millions of mobile device IDs.

In the face of privacy concerns, smartphone makers like Apple and Google have added more user controls so people can opt-out of location tracking and application developers provide more explicit privacy policies. Yet there have been widely reported instances of data brokers skirting safeguards. In August, the Federal Trade Commission sued a company for selling location data that could be traced to individuals’ movements to and from reproductive health clinics and other sensitive locations.

“This location data is very useful and also is somewhat risky because of the track record of some data vendors in this space,” said Joel Davis, director of the University of Florida’s Miller Retail Center and a clinical professor in information systems and operations. While there is limited government oversight today, regulation could limit the future return-on-investment companies can expect when buying into mobile location data, he said. For example, California adopted a consumer privacy act that allows users in the state to request companies permanently delete location data they have on them and allow them to opt-out of the sale of their personal information. “I do think in the next five, six years we’ll see more regulation in the space,” he said.

Katz and Wordes said their companies take seriously privacy and security concerns, but they see little reputational risk in their use of aggregated, anonymized data to analyze the ebb and flow of the devices people carry. “I don’t think there is risk in the way we are using it,” Wordes said. “Someone who has the raw data, they may be taking a risk. We are dealing in aggregated data.”

Among other limitations of mobile location data is it’s unable to track vertically — so it can’t pinpoint whether a visit was on the first or fifth floor of a building — can’t tell whether a visitor spent any money, and it doesn’t do well in small spaces, like determining if a person visited a nail salon or a Subway restaurant next door, Katz said. “You have to be careful on the assumptions you are using,” he said. High visitation at a location may not correlate to high performance. “We spend a ton of time teaching and supporting users because these use cases get complicated.”

This brings up another potential barrier — the high cost to access the data, not to mention the additional expense of hiring advisory services to analyze and understand how to use it. These cloud-based location data services can cost tens of thousands of dollars a month, depending on the number of users and the size of a business. “It’s expensive data,” Davis said. “If you are a really large retailer or restaurant chain you can spread the cost around quite a bit. If you’re a mom and pop with two locations, it’s hard to see how you get the return.”

Another potential pitfall: companies may find that the dense data is of little use on its own and they choke in an avalanche of information. Imagine receiving a data set of time-stamped pings of the longitude and latitude of 10 million phones across Florida 10 times a day for two years, Davis said. Or how about just from a single ZIP code with 10,000 devices? “It’s still more data than you can deal with,” he said. Companies need a plan for making use of all the data, either by hiring data scientists or contracting with an external provider who has the expertise.

Shopping center case study

On the flip side, this landscape can provide a competitive advantage for companies with the skills and experts in data science and computer algorithms who can extrapolate key information to unlock potential opportunities for tenants, landlords, developers and investors.

To cite one macro example, Creditntell’s analysis of a large data set showed that monthly visits to gyms nationwide have been, on average, about 13% higher this year than in 2019. Its analysis also revealed that a retailer in a shopping center that also has a gym receives, on average, 2.5% more visits a month than the same retailer’s locations in centers without fitness businesses. And this tidbit: niche and local fitness studios nudged up the foot traffic to nearby tenants more than national gym chains. Such nuggets may spark an idea for the operator of a local retail center who is looking to turn a property into a “lifestyle center” to combat online shopping trends.

More often than not, industry experts said major users of mobile location data services do so in part because they want to reduce risks of choosing a poor location or making the wrong investment. That may have been the case for a Baltimore-based real estate investment and management firm that recently explored purchasing a 16-year-old shopping center northeast of metropolitan Atlanta. The company, which TSCG could not name for confidentiality reasons, hired TSCG to examine the trade area and assess whether to purchase the 330,000-square-foot shopping center, whose tenants included a Sprouts Farmers Market, DSW, Barnes & Noble, Chili’s and other restaurants.

TSCG conducted an analysis using mobile location data, local demographics and spending patterns that showed the property was one of the top-drawing shopping centers of its type in the area, with better visitation than similar ones nearby, and its primary trade area was larger than might otherwise be expected. TSCG’s analysis also indicated that the region had a nice bounce back from 2019 and the beginning of COVID pandemic. “Across all major retail sectors, the region showed an increase in the total spending, which gave comfort to the client knowing that the projected growth of the area was there,” said Bryan Chandler, TSCG’s vice president of technology and innovation.

In the end, the company bought the center for $97 million, and it is looking to expand its real estate holdings in the Southeast, he said.