Real Estate Tokenization

Illustrations by Ben Simons.

Since the early 2000s, blockchain technology has evolved into a widespread wave of innovative efforts that reached all corners of the financial industry and real estate is no exception. The traditional transfer of real property involves several key elements including title, deed, mortgage, and leases that must be organized, filed, and recorded. Often several intermediary parties (e.g. brokers and lawyers) must be engaged to advise throughout this process. These features combined with the size of each transaction contribute to the illiquidity of real estate markets. The concept of real property tokenization is said to ameliorate many of these barriers and potentially ‘free up’ real estate markets.

What is Real Estate Tokenization

At its core, the tokenization of real property involves the digital fractional representation of asset rights and ownership via blockchain technology. Real estate tokenization employs Distributed Ledger Technology (DLT) and smart contracts to execute and record transfers of real property ownership in ways that are faster, cheaper, and overall more efficient than what is currently available under the traditional framework. At least this is the theory since the application is limited to a few trial attempts so far. It is the combination of fractional ownership, smart contracts, and distributed ledger technology that translates into tokenization.

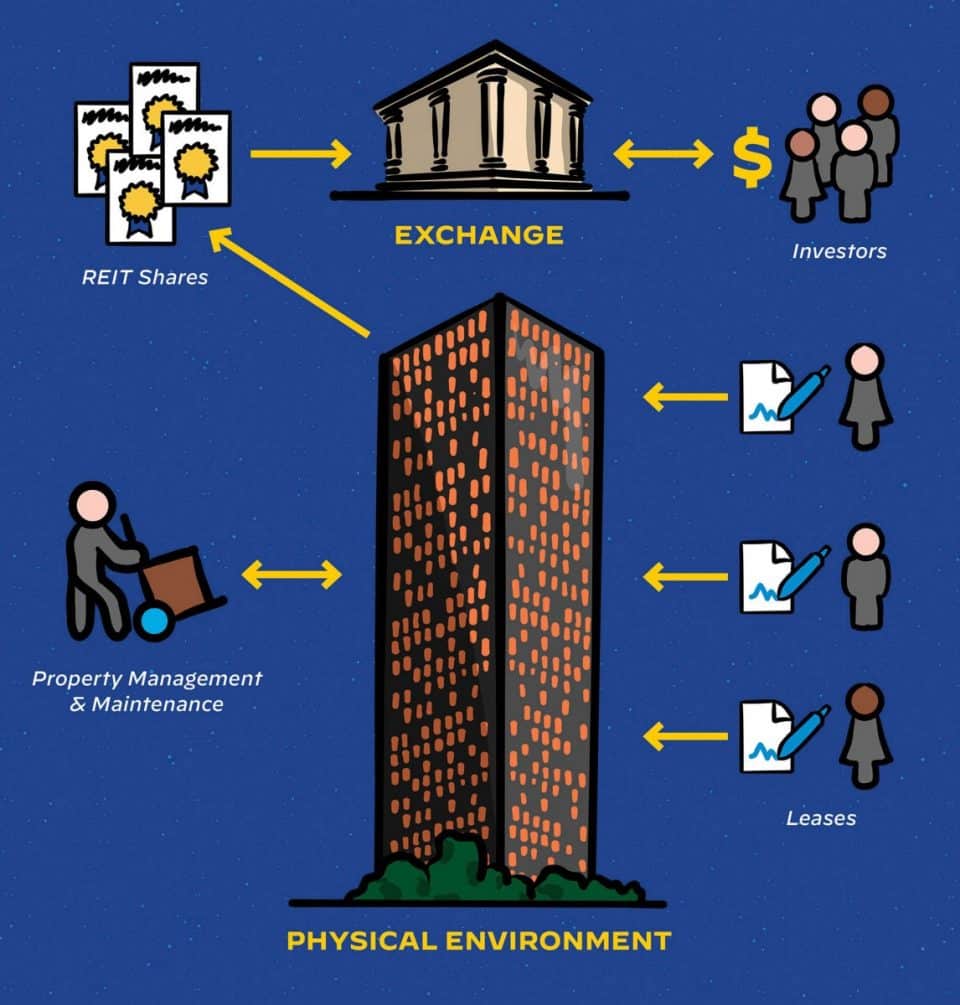

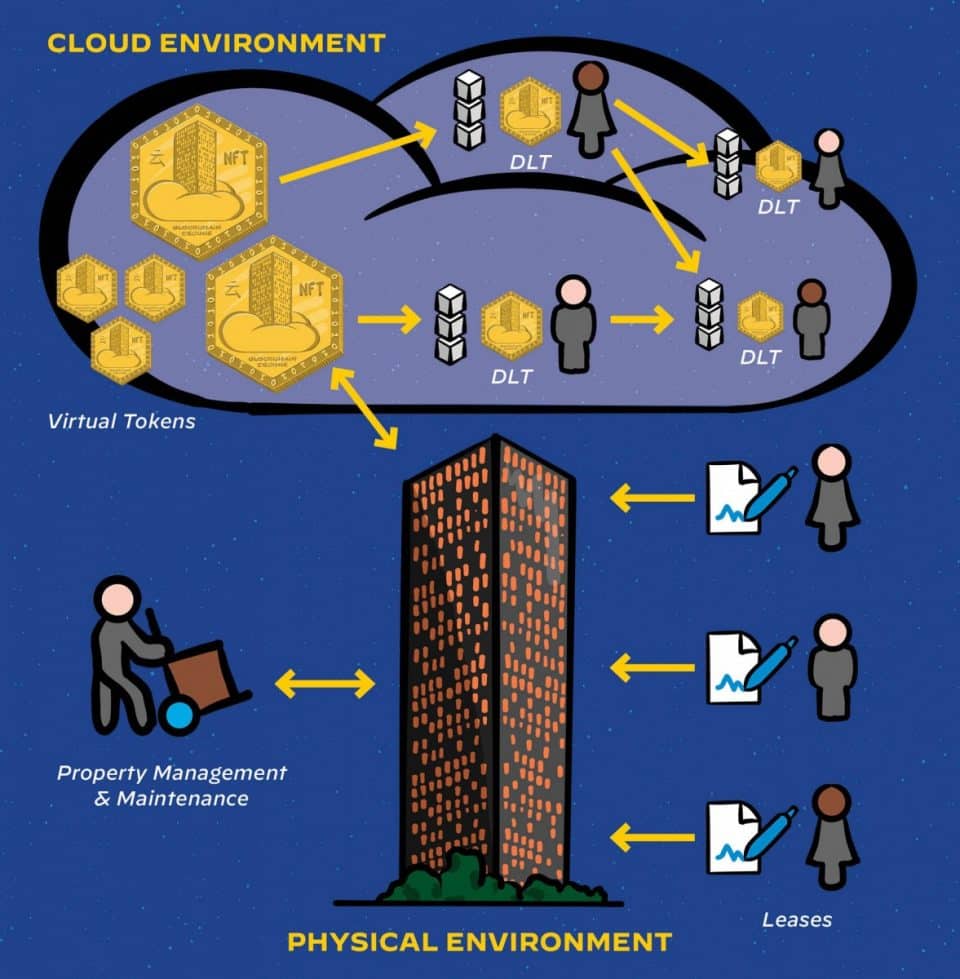

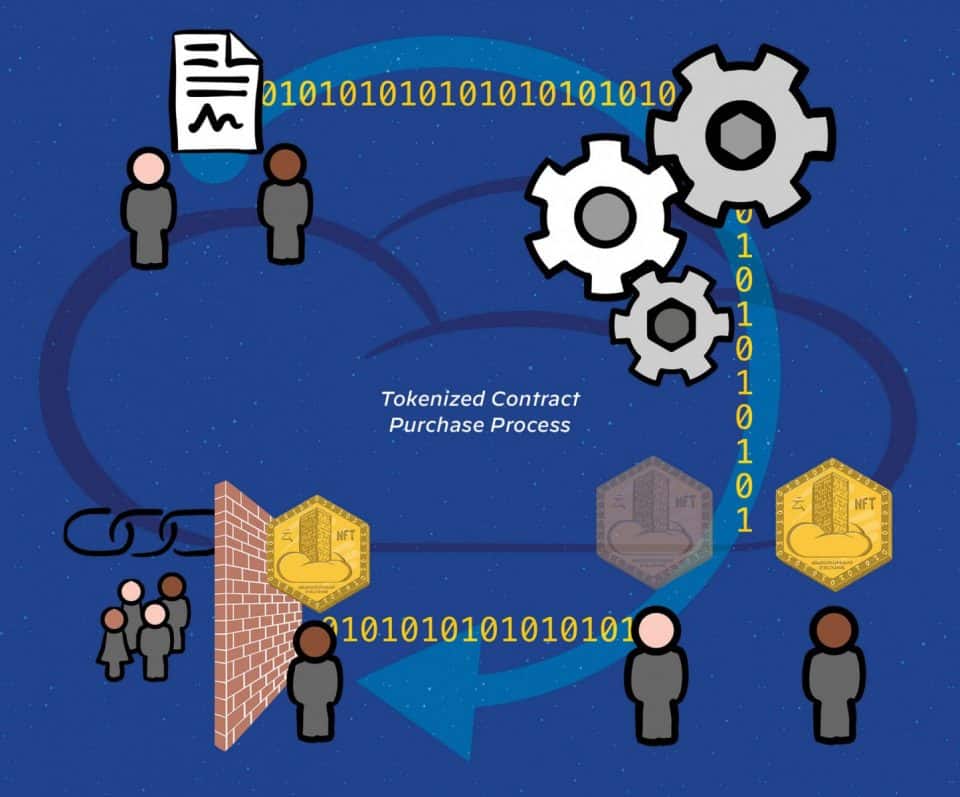

Real estate is acquired and tokenized in a way similar to the structure of REITs. A legal entity that owns real estate can issue security tokens and sell them directly to investors. Each token represents a share in the rights and ownership of the underlying physical asset. Investors in real estate security tokens can enter trades in secondary public markets analogous to public stock markets in which shares of REITs are traded. In both instances, each share (token) represents the fractional ownership of physical real property. In the REIT case, secondary trades take place on an exchange or through a private placement network, as shown in Diagram 1, whereas token real estate is traded in a cloud environment directly between investors with the record kept in the digital ledger depicted in Diagram 2.

A growing trend towards economic decentralization gave rise to an economy formed by peer-to-peer (P2P) online platforms. The timely emergence of blockchain technology in 2008 provided a way to achieve the virtual disintermediation and automatization of transactions. Blockchain technology is designed as an immutable, shared, and synchronized virtual database that works in a disintermediated way among various users. Real Estate possesses many of the characteristics that blockchain technology was designed to address. More specifically, two components of blockchain technology make it ideal — at least in theory — for real estate: smart contracts (blockchain-based digital legal contracts) and distributed ledger technology (decentralized keeping of records).

Distributed Ledger Technology

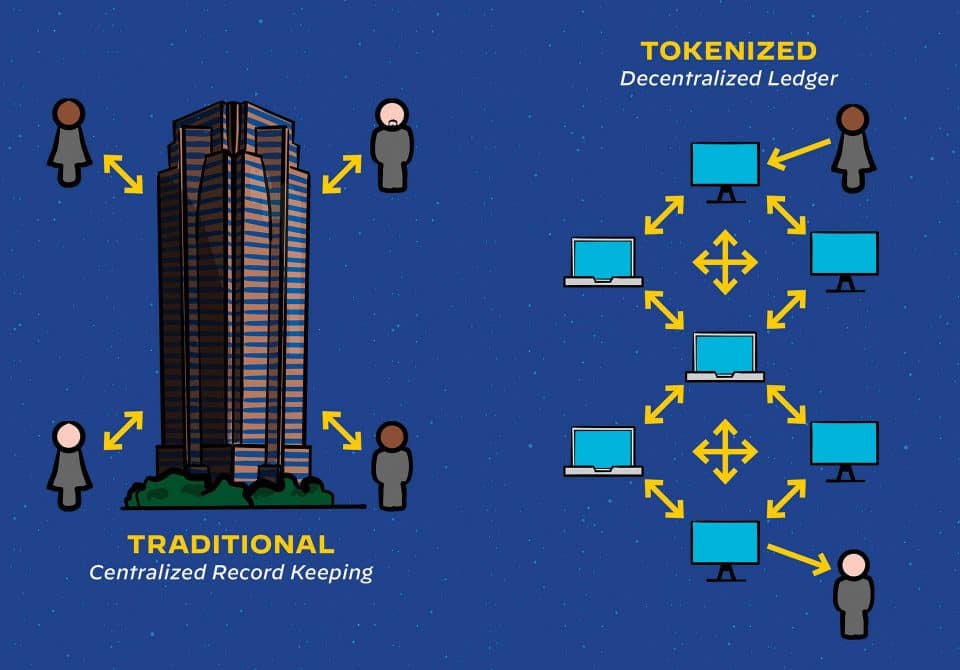

An inherent attribute of blockchain technology is the distributed ledger, commonly referred to as DLT. This is the underlying digital infrastructure that allows for the nearly instantaneous validation and recordation of all transactions across a network of nodes distributed across the globe. That is, for a transaction to be validated and recorded, every node on the network must agree that such a transaction took place. Diagram 3 reveals the distinction between the traditional model and the tokenized model. Traditionally, all transactions go through a central authority that everyone believes to be accurate and confidential. Investors’ rights are determined by the records in this central agency. A transaction in the tokenized decentralized model occurs when all parties (nodes) on the network agree that it has taken place and is thereafter supported by the agreement of all parties. Anyone attempting to manipulate or defraud the system would fail to obtain unanimous support.

Just as every transaction is transparent and immutable, so is the proof of ownership. This protocol enables a secure decentralized digital base that eliminates the need for central authorities or intermediary third parties. The proof of ownership can be distributed to all parties instantly. If we wish to transfer ownership to someone else, the digital smart contracts assigned to each security token enable this to happen quickly and at a low cost. Smart contracts (complex programs that function across the ledger) allow for more sophisticated transactions than the simple allocation of tokens, such as the mechanism behind bitcoin.

Smart Contracts

Smart contracts are the digital successor of the countless legal documents associated with real estate transactions. Smart contracts refer to the embedded protocol that is used to impartially guide every tokenized real estate transaction. Legal agreements involving real estate must automatically allow blockchain technology to implement and enforce equity transactions related to the token. As such, smart contracts are intentionally created to make the different features related to the token, such as dividend distributed or sales to other investors, fully automated and frictionless.

The images in Diagram 4 depict the structure of smart contracts. Initially, parties to the agreement establish the rules and conditions necessary for operational actions such as rent payment, property management, and ownership transfer. This contract is then digitized and publicly recorded, waiting for any condition to be met. Upon meeting a condition, the contract executes, leading to an automated result such as ownership transfer. Given the public nature of these contracts, regulators and all market participants can review the blockchain record while keeping the individual subjects anonymous.

Tokenized real property exchanges listed within a smart contract enable buyers to claim ownership when conditions set by the contract are met. Aside from the transfer of ownership, smart contracts can be embedded with other necessary legal agreements such as property management, recurring rental payments, scheduled escalations, etc. Thus, the expensive intermediary parties once crucial to each real property transaction would no longer be needed. The application of these digital automated features within real estate would essentially free up markets across the U.S. by boosting the liquidity of real property assets.

Implications of Real Estate Tokenization

An Interview with Anthony Tuths, KPMG

The concept of blockchain-based tokenized property, real or other, has been receiving a lot of attention in recent years. Some of the benefits of tokenization are very clear. First, the amount of paperwork required to complete a property transaction is dramatically reduced with smart contracts automatically processing the legal logic embedded in the transfer of ownership. This will not only reduce the time and effort of each transaction but will also reduce the costs of execution. Fewer parties will be needed to verify and validate the process. These dynamics of tokenized assets make it a very attractive proposition from an efficiency standpoint. According to Anthony Tuths, KPMG, “every asset is going towards the tokenization direction.”

What about liquidity?

Tokenization of real property may provide some liquidity features that have not been seen before in real estate markets. Typically, real property is extremely illiquid — properties are transacted infrequently and in large blocks.

As Anthony points out that “selling a .005% interest in a property can do a lot in the way of providing liquidity in the market. The cost of entry becomes very low which drives up liquidity. The barriers to entry are largely reduced because transactions become much faster and cheaper without the need for lawyers to transfer ownership.”

Tuths also commented on the price discovery benefits of tokenization: “Tokenized real property that is transacted on the blockchain is fully transparent for anybody to see. That is, everyone can see the transactions in real-time, as opposed to scouring through public property records. Price discovery occurs in real-time making real estate markets more efficient.”

Does tokenization impact transparency?

Blockchain and DLT form an immutable record of ownership for each tokenized asset. “It’s transparent,” Tuch says. “Everyone can see where the ownership is and how many units are recorded. We did not have this in the past. You can also see if there are transactions in the property and the amounts involved.”

How are tokenized real property assets taxed?

Just as with physical asset investments, there are tax implications that must be fully understood in order to make sound investment decisions. Tokenized real property is novel and largely unexplored territory, but according to Tuths, the world already knows how to treat fractionalized real estate. “Tokenized real property is not treated any differently than physical property if the token is directly backed by the ownership in real estate. Each token is treated exactly the same as the underlying real estate.”

However, there can be some newly added quirks: “Sometimes the token is backed by an indirect link and it can start to look like something very different. This has not taken off as fast because investors are concerned. They want to know they own the real estate.” Tuths added. “Otherwise, it is treated like regular real estate, domestically and internationally. If a piece of US real estate is transferred to a non-US person, the non-US person will have an interest in US property and will have to pay US taxes. Foreign investors do not like to hear this.”

How is tokenized real property different from REITs?

“REITs are good for their specific purpose. This isn’t very dissimilar. REITs were invented to allow a greater population of people to participate in commercial real estate investment. Regular people cannot buy a piece of commercial real estate; let alone a portfolio. REITs were a way to democratize real estate ownership. This is essentially what tokenization does except it includes all types of real estate, not only commercial. Each property can ultimately be fractionalized into very small shares and anyone can be a fractional owner of any real estate via tokenization. This allows for a much broader investor base with more democratic ownership.”

What are the legal implications of tokenized real property?

“In the brick-and-mortar world, if you’re buying a building, you get a deed and can see the building. In the tokenized world there are a lot of scams. Investors need to be careful who they are dealing with. They need to make sure that the token represents a real piece of real estate.

Is there any recourse for victims of these scams?

“Other than normal fraud statutes, no. However, this should change very soon. Once tokens are classified as securities, securities laws will kick in. There are anti-fraud provisions in securities law that protect against these kinds of situations.”

What should concern investors?

“One obvious concern is that there are no personal guarantees with tokens. If I used a mortgage to purchase a tokenized building and stopped making the mortgage payments, there is essentially no recourse for the banks. The credit for the security piece needs to be worked out.” Additional problems can arise when fund interest is tokenized. If a fund sells partnership interests to the public, the fund would be in violation of securities law because the investors are not registered with the SEC.

At this point, nobody is behind the curve of real estate tokenization. It is a nascent market. Given its very decentralized nature, estimating market size is a fool’s game. Tokenized real estate is a bigger topic of conversation than it is an existing market. One estimate by Security Token Market STM puts the tokenized real estate market cap at $25.75 million. So far, it seems that only small properties are testing out the market. However, understanding the possibilities allows us to recognize the conditions that may lead to an entirely new way of conducting business.