International Accounting and Auditing Center

Transparency into transformation

Why simply accept change when you can investigate how it unfolds at multiple levels? Accounting, as a profession, remains in a state of constant transformation. Updated regulations, emerging technologies and restructured business environments all affect how professionals do their jobs — whether they’re trying out a new AI tool or having a voice in company-wide financial decisions.

These effects also extend to institutions like the University of Florida Warrington College of Business’ Fisher School of Accounting. Our International Accounting and Auditing Center assesses the impact of these measures to instruct our students in the realities of the field and inform practitioners of their developments, with the goal of producing a more adaptable and aware workforce.

At the same time, we recognize that we’re far from alone in our pursuit. Today, firms are expected to follow more globally uniform practices, serve an international clientele, and report on digital transactions and cryptocurrency. In turn, we partner with prominent accounting institutions all over the world to establish new practices and ensure these changes are reflected in the education we all provide.

Review our research and initiatives to see how we’re directing the accounting profession’s ongoing progress.

Accounting research areas and initiatives

There’s always a way to make reporting, auditing, and analysis more efficient, accurate, and effective. We’ll tell you about it here, as well as in our annual newsletter and our inDEPTH articles.

European Union auditing standards

We partnered with Maastricht University to compare auditing standards used by the United States and the European Union to understand how their differences affect compliance for international firms.

Audit quality

Through a request from the Public Company Accounting Oversight Board, we collaborated with other universities to address disparities among the academic, professional, and regulatory definitions of audit quality and create standards based on input, process, outcome and context.

Audit report accountability

Something as simple as a signature — a standard process in Europe that’s absent in U.S. firms — adds another dimension to reporting, recordkeeping and the information provided to financial statement users.

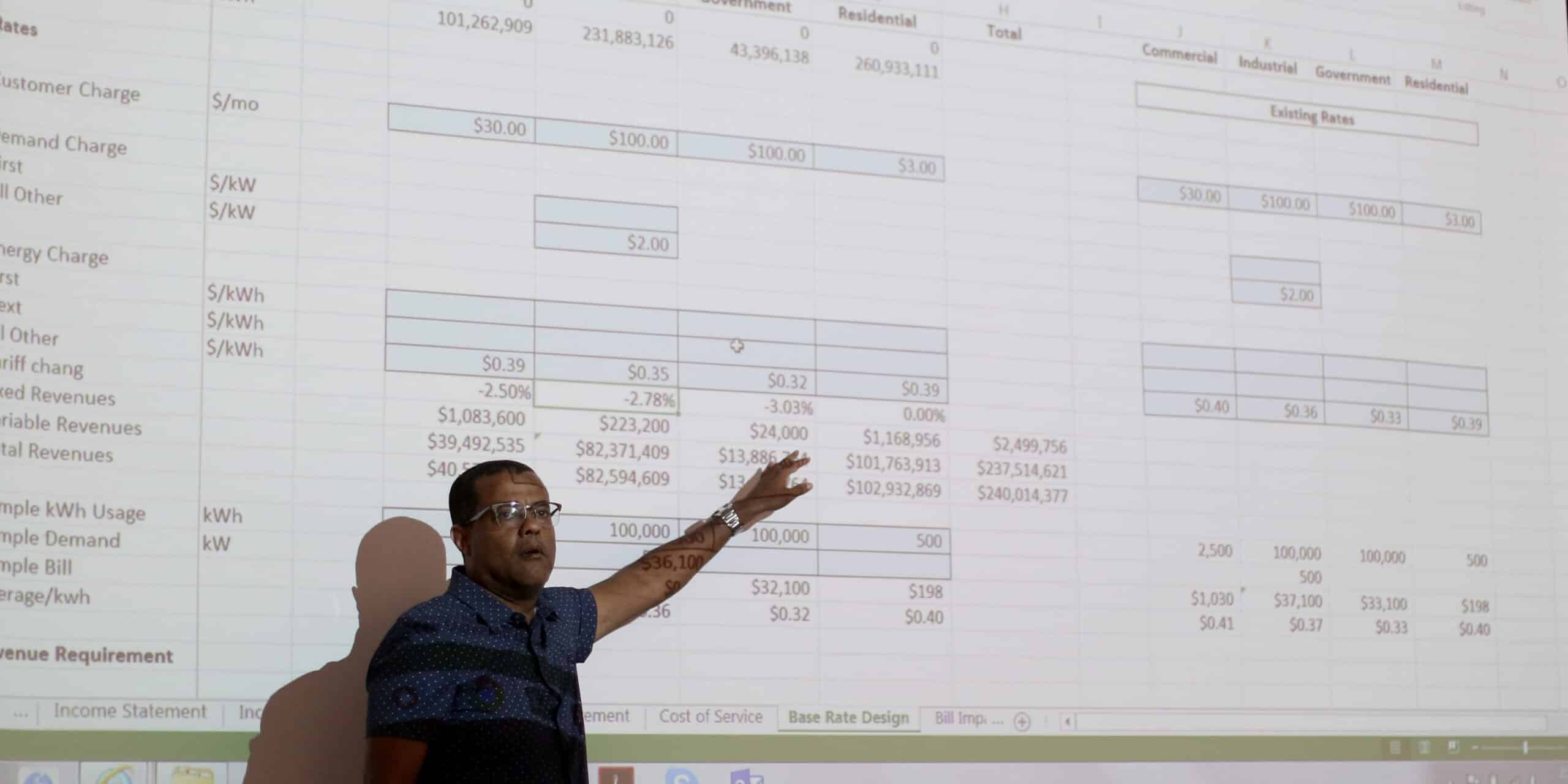

Audit fees

Adopting international accounting standards means undergoing an audit and paying subsequent fees. Our research attempts to understand who’s most affected by this practice and how.

inBRIEF newsletter

Published annually, inBRIEF highlights the center’s ongoing activities and covers key topics through an in-depth yet non-technical focus based on existing accounting and auditing research.

Research talks

Watch Professor W. Robert Knechel’s talks on the economic importance of accounting audits, what constitutes a “good” audit and current challenges in the audit profession: technology, process and culture.

About the center

Our center strives to advance the overall academic and educational goals of the Fisher School of Accounting on an international level. This mission includes bringing a broader international focus to our programs and research efforts and increasing the global visibility of the school’s faculty, students and scholarship.

International collaborations

The center fosters interactions and collaborations with international accounting and auditing scholars. As part of this objective, we regularly host international visitors on a short- or long-term basis, including for our competitive scholar-in-residence program.

Exchange program

Our growing exchange program supports Fisher faculty and Ph.D. students who wish to expand their research opportunities abroad. Past exchange placements have included Maastricht University in the Netherlands and KU Leuven, outside of Brussels.

Our location

You’ll find the International Accounting and Auditing Center on the second floor of Gerson Hall in the renovated Andersen reading area. This location provides a focal point for the center’s activities and includes an office for international visitors.

InDepth articles

Submissions for InDepth, the center’s publication of detailed articles about accounting and auditing, are considered by the center director. Send a 100-word summary of topics to be included.

Submission next steps

If your idea is accepted, you will be asked to expand the summary into a 1,500-word essay. Any topic related to accounting research is of interest, but it must be well defined and amenable to summary within the word limit. Full-length essays should meet the following guidelines:

- There should be no equations, mathematical notation, or other technical representations that hinder the conversational flow of the essay.

- There should be no statistics other than summary measures (e.g., means) used to highlight and give perspective to key points.

- Citations are not needed in the text itself.

- Footnotes should be used sparingly.

- A reference list of key papers in the topic area should be included.

Accepted essays will be made available through the center website in electronic form. Selected essays may be published in paper form as part of the center’s inBRIEF newsletter.

Visiting scholars

Visiting scholars are advanced Ph.D. students or recent graduates who wish to gain international research experience.

| Name | Affiliation | Country |

|---|---|---|

| Xiaotong Deng | The University of New South Wales | Australia |

| Alfredo Sarlo Neto | University of São Paulo | Brazil |

| Adam Arian | Australian Catholic University | Australia |

| Godsway Kadey | University of Technology Sydney | Australia |

| Name | Affiliation | Country |

|---|---|---|

| Meng Guo | Aalto University | Finland |

| Filipe Casellato Scabora | University of São Paulo | Brazil |

| Carla Gravellu | University of Cagliari | Italy |

| Lina Li | Auckland New Zealand | New Zealand |

| Luiz Fernando | Distadio Griffith University | Australia |

| Yahya Yilmaz | University of Münster | Germany |

| Ying Jin | University of International Business and Economics | China |

| Thi Thuy Dung Nguyen | Universidad Carlos III de Madrid | Spain |

| Paulo Victor Gomes Novaes | Federal University of Minas Gerais | Brazil |

| Emeline Deneuve | ESSEC Business School | France |

| Romina Rakipi | University of Pisa | Italy |

| Mohammad Jizi | Lebanese American University | Lebanon |

| Merve ACAR | Ankara Yildirim Beyazit University | Turkey |

| Marvin Nipper | University Duisburg-Essen | Germany |

| Melissa Cagle | Dokuz Eylul University | Turkey |

| Christian Friedrich | Technische Universität Darmstadt | Germany |

| Gerken Fynn | University of Antwerp | Belgium |

| Tianshi Li | University of International Business and Economics | China |

| Valeria Volpentesta | Dokuz Eylul University | Turkey |

| Nelson Ma | University of Technology, Sydney | Australia |

| Dale Fu | University of New South Wales | Australia |

| Yutao Chen | Southwestern University of Finance and Economics | China |

| Chenyu Zhang | University of International Business and Economics | China |

| Sven Hoerner | Julius-Maximilians-Universität Würzburg | Germany |

| Silvia Triani | University of Parma | Italy |

| Malik Lachman | Technische Universität Berlin | Germany |

| Simon Dekeyser | KU Leuven | Belgium |

| Lisa Frey | University of Passau | Germany. |

| Shouwen Zhang | University of International Business and Economics | China |

| Antti Miihkinen | Aalto University School of Business | Finland |

| Johanna Kluber | Technical University of Dortmund | Germany |

| Herman van Brink | Nyenrode University | Netherlands |

| Inez Verwey | Nyenrode University | Netherlands |

| Adriana Rossi | Universita G.D’Annunzio | Italy |

| Cheng Gao | Renmin University | China |

| Steve Salterio | Queens School of Business | Canada |

| Lei Zou | Maastricht University | Netherlands |

| Christophe Van Linden | KU Leuven | Belgium |

| Amin Salimi Sofla | Umea University | Sweden |

| Jukka Karjalainen | University of Eastern Finland | Finland |

| Jigao Zhu | University of International Business and Economics | China |

| Sakshi Girdhar | Aarhus University | Denmark |

| Marlene Willekens | KU Leuven | Belgium |

| Ashna Prasad | University of New South Wales | Australia |

| Like Jiang | ESSEC Business School | France |

| Antti Miihkinen | Aalto University | Finland |

| Chris Chapman | Imperial College of London | United Kingdom |

| Nadine Funcke | Maastricht University | Netherlands |

| Beryl Huang | Vrije Universiteit Brussel | Belgium |

| Sam Han | Korea University Business School | South Korea |

| Chris Hardies | Vrije Universiteit Brussel | Belgium |

| Mikko Zerni | University of Vaasa | Finland |

| Beryl Huang | University of International Business and Economics | China |

| Mattias Hamberg | Norwegian School of Economics and Business Administration | Norway |

| Jorn Basel | ESCP Europe Business School | Europe |

The Fisher School of Accounting and the International Center for Research in Accounting and Auditing welcome short-term visiting scholars. A short-term scholar is an individual engaged in conducting research, observing, consulting, teaching, training or lecturing for a period of six months or less.

Visiting scholars will need to provide their own funding and must meet UF funding requirements and regulations. The Fisher School will provide visiting scholars access to a computer, office space, an email account and the library.

Short-term scholars must be nominated by a faculty member in their institutions and sponsored by a Fisher School faculty member. In selecting visitors, preference will be given to doctoral students who are advanced in their research program or post-docs who can contribute to the Fisher School research environment.

Application procedures

- Nominations by each scholar’s faculty member must be sent between November 1 and March 1.

- The nomination package should include:

- The scholar’s statement of purpose — no more than two pages describing the scholar’s interests and the work that he or she intends to do at the Fisher School, including any classes to be attended. The statement must also explain why the Fisher School is the appropriate place for the scholar’s planned work and how they can contribute to the research environment at Fisher.

- A letter from the Fisher School faculty member who will act as the sponsor.

- A current CV.

- Any published work.

- A statement of support from the home institution, preferably from their thesis supervisor.

- Evidence of financial support for the duration of the visit. (Note: If funding is conditional on acceptance of the visitor to Fisher, a conditional acceptance letter will be issued, but proof of financial support must be provided prior to arrival on campus.)

- Students are expected to arrive near the start of a new term (August or January).

These materials should be sent by email to W. Robert Knechel, Director of ICRAA.

International accounting resources

Find answers to all your questions about reporting, auditing requirements, regulations and international accounting standards.

- Accounting Standards Board of Japan

- Australian Accounting Standards Board

- Belgian Accounting Standards Board

- China Securities Regulatory Commission

- European Commission

- Financial Accounting Standards Board

- Financial Reporting & Assurance Standards Canada

- IFRS Foundation

- International Organization of Securities Commissions

- Korea Accounting Standards Board

- Malaysian Accounting Standards Board

- Public Company Accounting Oversight Board

- U.S. Securities and Exchange Commission, Conceptual Releases

- U.K. Financial Reporting Council

- Accounting, Organizations and Society

- Advances in Accounting

- Auditing: A Journal of Practice and Theory

- Contemporary Accounting Research

- Current Issues in Auditing

- European Accounting Review

- International Accounting Bulletin

- International Journal of Auditing

- Journal of Accountancy

- Journal of Accounting and Economics

- Journal of Accounting Research

- Journal of International Accounting, Auditing and Taxation

- Journal of International Accounting Research

- Review of Accounting Studies

The latest news

Center events

Change, quantified

Observe, understand, and act on every development with research and guidance from Warrington’s International Accounting and Auditing Center.

Contact us

International Accounting & Auditing Center

Fisher School of Accounting

University of Florida

PO Box 117166

Gainesville, FL 32611

352-273-0215

W. Robert Knechel

Director

Email Robert