The age of generative AI

We are witnessing a paradigm shift in digital transformation from predictive artificial intelligence (AI) to generative artificial intelligence (Gen AI), the generative systems that can produce human-like text, code, images and more. New technologies like OpenAI’s ChatGPT, Google’s Gemini, Meta’s LLaMA and Anthropic’s Claude have made Gen AI a common topic of discussion. These systems can combine knowledge, mimic reasoning and produce clear narratives on a large scale. Gen AI technology offers significant opportunities to improve productivity, but it also poses risks in areas such as misinformation, financial instability, data governance, security, and the job market.

To understand how Gen AI is transforming financial activities, we explored the latest research studies and data on a technology that is widely viewed as transformative —as well as challenging and fraught with risks.

What Is Gen AI — and why now?

AI broadly refers to technology that enables computers and machines to simulate human learning, comprehension, problem-solving, decision-making, creativity and autonomy. AI has been researched and developed since the 1950s, but it wasn’t until November 2022 and the release of ChatGPT that headlines focused on breakthroughs in Gen AI. In principle, Gen AI is a technology built on the foundations of machine learning and deep learning and is evolving to create original text, images, video and other content (Figure 1). Gen AI is reshaping workflows, decision-making and creative production across industries.

Converging trends have enabled this progress:

- Computing power: Cloud computing and graphics processing units (GPUs) have enabled massive-scale model training since the 2010s;

- Data availability: Open internet text, code repositories and user-generated content provide the fuel for data pretraining;

- Algorithmic innovation: The transformer architecture introduced since 2017 has proven highly effective for sequential modeling.

Apart from traditional AI models such as machine learning and deep learning algorithms, Gen AI models are user-friendly, designed to interact and produce outputs in intuitive, human-like ways. Their ability to mimic natural conversation, the availability of freely accessible online versions, and Gen AI-like applications have made adoption and engagement straightforward for the average user.

Use cases

AI tools are already deeply applied in myriad domains of financial activities. The Gen AI tools inherit the properties of AI tools and offer further enhancements.

Traditional AI models have been used in back-office functions, including prediction, operational optimization, risk modeling, fraud detection and automated credit underwriting of various financial service verticals.

In asset management, BlackRock’s Aladdin platform uses AI (machine learning) to simulate market scenarios, assess portfolio risk and guide investment decisions for institutional clients. In algorithmic and high-frequency trading, firms like Citadel Securities and Two Sigma use AI to enhance execution strategies and manage liquidity in real-time. In risk management, payment companies such as PayPal and Mastercard use AI to deploy anomaly detection tools to spot suspicious transactions.

Meanwhile, Gen AI is making an impact on the front office of customer interactions. Gen AI, powered by large language models (LLMs), marks the next step by adding language-based reasoning and creativity to what AI can already do. Its human-like conversation skills and content creation tools are changing customer support, marketing and sales, and product development (Table 1). Financial institutions now use Gen AI to create personalized product recommendations, automate regulatory reporting and even write or debug computer code. In addition, Gen AI can process and interpret new forms of largely unstructured data, thereby improving the back-office functions — asset management, trading (algorithmic and high-frequency), compliance and risk assessment. Use cases include Bloomberg’s recently introduced a financial assistant powered by a finance-specific LLM. Goldman Sachs’ investment banking division uses LLMs to support in-house software development through coding assistance.

Table 1 – Use cases of AI and Gen AI

| Category/Function | AI capabilities in finance | Gen AI enhancements in finance |

|---|---|---|

| Customer Support & Operations | Traditional chatbots and automated call centers. Process automation for back-office operations and reconciliation. | Conversational, human-like chat interfaces for customer service. Summarization of client communications and ticket resolutions. |

| Marketing & Sales | Target segmentation and recommendation engines based on ML algorithms. Optimization of sales strategies using predictive analytics. | Generate personalized sales content, campaigns, and recommendations. Create marketing materials and financial education content tailored to clients. Automate brand-consistent responses across platforms. |

| Product Development | AI models used in robo-advisors for investment advice and product recommendations. | Human-like customization and delivery of financial advice via Gen AI-powered robo-advisors. Generate or optimize product features using natural language interaction. |

| Asset Management | Stock selection and portfolio optimization using ML models. Risk management through real-time monitoring and scenario analysis. Pattern recognition for sentiment and quantitative analysis. | Generate summaries and insights for investment reports. Create natural-language explanations of risk and portfolio performance. Enhance communication between advisors and clients with tailored investment summaries. |

| Trading (Algorithmic & High-Frequency) | Liquidity and order execution optimization. Dynamic, data-driven decision-making without human intervention. Predictive analytics for market movement and order flow management. | Generate real-time analytical commentary on trading performance. Summarize or translate trading reports. Assist with algorithm documentation and code development for trading systems. |

| Compliance & Risk Management | Pattern recognition for regulatory breaches and anomaly detection. Continuous monitoring of risk factors in portfolios. | Draft compliance documentation and regulatory filings from firm data. Summarize large volumes of legal and regulatory text. |

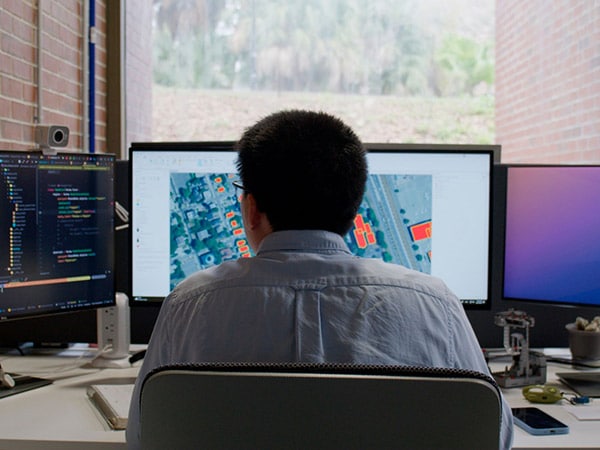

The shift is equally profound in real estate, an industry sector sitting on vast stores of data about properties, tenants, leases, locations and market trends. AI tools have been supporting predictive analytics — forecasting market trends, evaluating property values, and identifying investment opportunities through historical data and pricing models. Gen AI adds interpretive and interactive layers. Real estate professionals can now automate the creation of property listings, neighborhood descriptions and marketing messages that cater to buyer preferences. Brokers can use Gen AI tools to personalize communication for many clients, conduct virtual tours, and even write follow-up messages. A prime example is JLL’s Dynamic Occupancy Management, an AI-powered platform to help tenants optimize office space in response to hybrid work trends. Its clients can use the tool to identify underutilized areas, average daily occupancy and demand for spaces like conference rooms. This approach enables smarter, data-driven space planning.

Risks and challenges

However, using GenAI comes with a long list of potential risks. These include:

- Misinformation: LLM-based models like ChatGPT are known to “hallucinate” – confident but incorrect outputs. This raises concerns for tools that interact with customers and for operations where accuracy is crucial in financial activities.

- Financial instability: Some studies suggest that as Gen AI tools become widely used, standardization among firms may encourage herding behavior and increase procyclicality, especially during market stress, which can lead to systemic risks.

- Competitiveness: The computational needs of Gen AI give large tech companies with extensive data and cloud resources an unfair edge of data concentration, risking oligopolistic control over key AI technologies. Anti-trust regulators are becoming more cautious of both intentional and unintended algorithmic collusion, particularly when reinforcement learning is applied in financial trading or pricing systems.

- Privacy and cybersecurity: The data-intensive nature of Gen AI heightens, mainly as firms increasingly rely on a narrow set of AI providers. In finance, where client data is highly sensitive, this introduces systemic vulnerabilities.

- Labor and productivity: GenAI is reshaping the financial workforce but also is stirring uncertainty about the future of work. While there is little evidence of large-scale job losses, a study shows that 14% of occupational tasks are directly automatable by LLMs, with another 22% indirectly exposed when paired with tools such as workflow automation. However, 64% of tasks remain unaffected. Firms are more likely to restructure roles when Gen AI targets core tasks, potentially leading to displacement. In contrast, when supplemental activities are automated, employees may be redeployed into higher-value roles to enhance productivity.

Adoption in business and finance

The use of Gen AI is gaining momentum: the latest McKinsey Global Survey found that 78% of respondents say their organizations have begun using AI in at least one business function, up from 55% in 2023 (Figure 2).

Figure 2 – Generative AI use by business and industry

Percentage of respondents confirming current application

| Business function | Technology | Professional services | Advanced industries | Media and telecom | Consumer goods and retail | Financial services | Healthcare, pharma, and medical products | Energy and materials | Overall |

|---|---|---|---|---|---|---|---|---|---|

| Marketing and sales | 55 | 49 | 48 | 45 | 46 | 40 | 29 | 33 | 42 |

| Product and/or service development | 39 | 41 | 39 | 26 | 21 | 25 | 22 | 17 | 28 |

| IT | 31 | 16 | 26 | 22 | 20 | 24 | 30 | 26 | 23 |

| Service operations | 30 | 23 | 24 | 37 | 13 | 26 | 14 | 13 | 22 |

| Knowledge management | 26 | 34 | 17 | 26 | 12 | 16 | 24 | 13 | 21 |

| Software engineering | 36 | 9 | 17 | 30 | 8 | 20 | 13 | 8 | 18 |

| Human resources | 16 | 17 | 13 | 22 | 8 | 11 | 7 | 16 | 13 |

| Risk, legal and compliance | 12 | 9 | 6 | 6 | 11 | 21 | 5 | 9 | 11 |

| Strategy and corporate finance | 14 | 14 | 21 | 10 | 7 | 7 | 6 | 5 | 11 |

| Supply chain/inventory management | 10 | 4 | 15 | 3 | 14 | 4 | 2 | 6 | 7 |

| Manufacturing | 5 | 3 | 13 | 3 | 8 | 0 | 5 | 7 | 5 |

| Using Gen AI in more than one function | 88 | 80 | 79 | 79 | 68 | 65 | 63 | 59 | 71 |

Marketing and sales are the most common business functions leveraging Gen AI, with 42% of all companies surveyed putting the technology to use. Predictably, this was exceptionally high in the technology industry (55%), followed by the professional services (49%), and advanced industries, such as automotive, aerospace and electronics (48%). Other business functions, like product and service development, information technology (IT) and service operations, also see significant AI adoption in tech-heavy sectors.

In the financial services industry, Gen AI is most used in marketing and sales (40%), service operations (26%), and IT (24%) , highlighting the sector’s focus on improving customer engagement, operational efficiency and digital infrastructure.

Pivoting to the job market, all but one of 15 sectors showed an increase in AI-related job postings in 2024, compared with 2023, according to Lightcast, a labor market intelligence firm that tracks AI job postings (Figure 3). Not surprisingly, the information sector leads with 9.3% of its job postings in AI-related positions, followed by professional, scientific and technical service jobs (5.3%) and the finance and insurance sector (3.8%). In real estate, rental and leasing, AI-related jobs climbed to 1.2% of postings, up from 0.9% in 2023.

While AI hiring is expanding across nearly every sector, the pace of adoption varies. Finance and real estate, in particular, are moving more slowly. This is partly due to the fact that both finance and real estate operate in heavily regulated environments. These sectors prioritize market integrity, consumer protection, financial stability, and are subject to requirements around risk management, model governance and operational transparency and other obligations.

Agentic AI and artificial general intelligence

While Gen AI has captivated the financial activities with its ability to produce human-like content, a new paradigm is emerging: agentic AI. It marks a shift from passive generation to active, independent decision-making. Unlike reactive LLMs like ChatGPT that respond to prompts, agentic AI systems are made to actively pursue goals, plan multi-step tasks, use external tools, and adapt to new information, such as execute computer code, use the internet, or perform market trades with little human supervision.

In finance, this evolution holds transformative potential. AI agents could automate complex front- and back-office processes to automatically run compliance audits, analyze real-time risk data, and independently design, price, and market the financial products. In addition, many AI agents can interact with each other and integrate across platforms simultaneously. These enable a level of autonomous execution that was previously unattainable. As this technology matures, we can expect agentic systems to drive everything, from robo-advisory upgrades to independent product lifecycle management. They will essentially serve as digital workforce layers that grow without limits on human capacity.

The rise of autonomous AI agents introduces novel risks. When AI agents become more widely adopted in finance, without proper oversight and safeguards, these systems could introduce serious vulnerabilities, such as cybersecurity breaches, fraud and unequal access. The industry may face challenges such as liquidity shocks or a growing structural dependency on AI-driven systems.

The relentless development of technology highlights a fact that neither Gen AI nor agentic AI have never been a destination of the on-going AI revolution. A growing number of AI researchers and industry leaders suggest that it is time for humanity to prepare for the possibility of the shift from today’s Gen AI and agentic AI toward a more ambitious frontier: Artificial general intelligence (AGI) — a system capable of performing the full range of cognitive tasks that humans can, across domains, with minimal supervision. There is an ongoing debate about how quickly AGI can be adopted — and should be. Strong opinions exist on both sides. The advancement and complexity of AGI make it challenging to predict its impact, potentially leading to unforeseen opportunities and risks. It makes sense to consider a variety of possible future scenarios.

References:

- Iñaki Aldasoro, Leonardo Gambacorta, Anton Korinek, Vatsala Shreeti, and Merlin Stein, 2024, Intelligent financial system: how ai is transforming finance, Technical report, Bank for International Settlements.

- Generative AI and Finance AL Eisfeldt, G Schubert – Annual Review of Financial Economics, 2024

- The AI Index 2025 Annual Report by Stanford University

- McKinsey global surveys 2024 “The State of AI: How Organizations Are Rewiring to Capture Value.”

- OECD, Gen AI in Finance, December 2023

Anh Tran, Ph.D., is a real estate researcher at the UF Bergstrom Real Estate Center.

Related stories

For the media

Looking for an expert or have an inquiry?

Submit your news

Contact us

Follow us on social

@ufwarrington | #BusinessGators