Why companies benefit from listing products on marketplaces like Amazon, even without making sales

New University of Florida research reveals how maintaining a marketplace presence gives suppliers strategic leverage with retail giants like Amazon and Walmart.

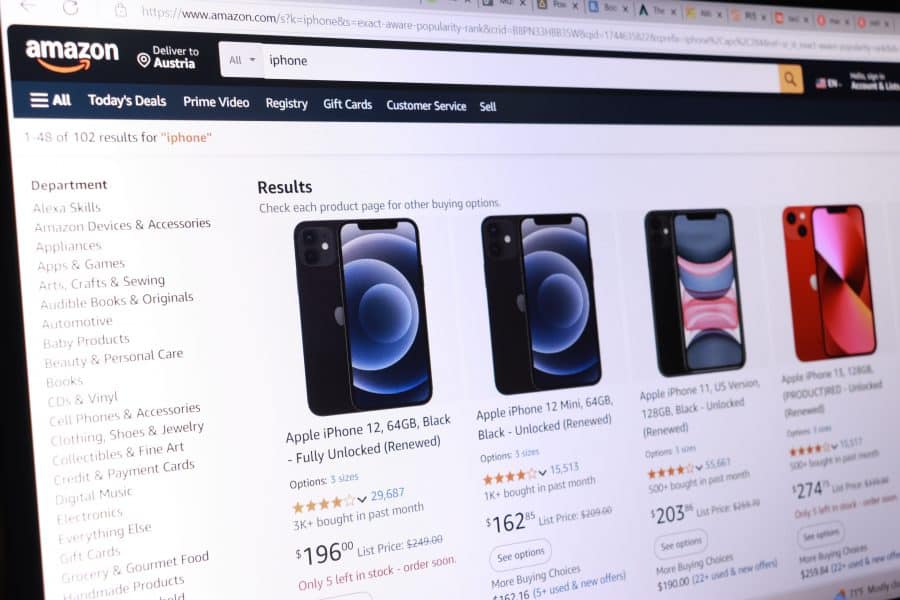

When companies like Dell, Samsung and Dyson sell their products online via Amazon or Walmart, they’re not just creating another channel through which customers can purchase their products. According to new research from the University of Florida Warrington College of Business, they’re gaining leverage over their business relationship with these retail giants.

The study examined how suppliers navigate selling through online retail platforms and uncovered a finding that supplying companies can use to their advantage. Specifically, suppliers benefit from maintaining a presence on retail platforms’ marketplaces even when they make few or no actual sales through that channel.

“The supplier’s presence in the marketplace incentivizes the retailer to order more through the reselling channel, while the supplier sets a lower wholesale price, benefitting both parties,” explained Amy Pan, study author and associate professor at UF Warrington.

The findings are centered around how major online platforms like Amazon, Walmart and JD, China’s largest online retailer, offer two ways for products to reach consumers. In a traditional reselling channel, the retail platform buys products wholesale and resells them. In an agency channel (marketplace), suppliers sell directly to consumers while paying the retail platform a commission fee.

When suppliers provide products through both options, even if the marketplace sales are low, it changes the dynamics. Retailers respond by ordering larger quantities through the traditional channel, and suppliers lower their wholesale prices. The outcome is a win-win for all parties.

There is one downside for suppliers, though, and it’s in opposition to the conventional wisdom that more information leads to better decisions. The research finds that when suppliers have access to retailers’ order information before making their own production decisions, they actually end up performing worse than those who decide simultaneously with the retailer.

“Providing the supplier with more information about the retailer’s order quantity can actually be detrimental to the supplier,” Pan said. “This finding challenges long-held assumptions about information sharing in supply chains.”

The research answers an important question for suppliers: Is having the option to sell products directly to consumers through a marketplace always beneficial? Pan’s findings suggest no. In situations where commission rates are intermediate, suppliers are better off without a marketplace option, even if they never intended to sell there.

For retailers, though, the findings are clear. It’s optimal for platforms to offer both channels when commission rates aren’t too low, which may explain why retail giants across the globe like Amazon and JD are continuing to offer both traditional and agency channels.

The full paper, “Supplier Encroachment Through Online Marketplaces,” is published in Production and Operations Management.

Researchers:

- Hongseok Jang (Ph.D. ‘21) – Tulane University Freeman School of Business

- Quan Zheng (Ph.D. ‘ 18) – The University of Science and Technology of China

- Amy Pan – University of Florida Warrington College of Business

Related stories

For the media

Looking for an expert or have an inquiry?

Submit your news

Contact us

Follow us on social

@ufwarrington | #BusinessGators